Category:Gov’t Debt & Spending

The Debt Luck Club | Life of Debt Episode 2

March 19, 2014 | Video

What would you do to get rid of your debt? Would you sell your childhood toys, your blood, or ‘other’ fluids? That’s the question Tom has to answer. Overburdened with student loans, he has stopped making payments, and is now forced to dodge phone calls from snarky debt collectors. What can he do to escape […]

Digging Out of Debt | Life of Debt Episode 3

March 19, 2014 | Video

They have your name, your number, and your credit card records. Debt collectors have a funny way of tracking you down and can take people to court. What can we do? For Lee Campbell, he can rely on keg colleague and college professor Peter Jaworski to magically appear and teach him a few tricks to […]

Life of Debt? How to: Obliterate Debt, Accumulate Wealth, and Retire Rich

March 18, 2014 | Video

Whatever kind of debt you owe, Learn Liberty Academy wants to help you relieve yourself of the burden. Engage in weekly webcasts, a discussion forum, and more — and you won’t owe a dime. In fact, we will be indebted to you for your participation!

The Interactive Great American Taxing Game: Tobacco

January 27, 2014 | Video

It’s the Great American Taxing Game and you have chosen to tax cigarettes to be paid by cigarette suppliers. Who actually bears the burden of the tax? Because smokers are pretty unresponsive to price changes, they are most likely to pay. This is not necessarily a bad thing: smokers pay higher prices and the government […]

The Interactive Great American Taxing Game: Oil Companies

August 13, 2013 | Video

It’s the Great American Taxing Game and you have chosen to tax oil companies. So what happens if you increase these taxes? And, perhaps more importantly, who will pay these taxes? While you may think raising taxes on oil companies will hurt the profits of big oil barons, consumers are likely to bear the burden […]

The Interactive Great American Taxing Game: Intro

August 13, 2013 | Video

Join the Great American Taxing Game with your host, Professor Art Carden. The question posed is who should be taxed. If you were a government official trying to raise revenue, would you choose to levy taxes on gas, on smokers, or on luxury goods? How would these taxes turn out? Prof. Carden explains that it […]

Does Government Create Jobs?

March 29, 2013 | Video

Many people have been talking about job creation lately, especially politicians. But is government the best creator of jobs? And is job creation the best thing for the economy? Professor Steve Horwitz explains that there is a difference between creating jobs and creating wealth. It would be easy to create millions of jobs overnight. For […]

Giving Away Money Costs More Than You Think

February 4, 2013 | Video

People and organizations incur costs when they compete for money that is “given” away. For example, if a college offers a scholarship to the student who writes the best essay on a particular subject, students competing for the scholarship will spend time and resources to create their essays and submit their applications. Although the chosen […]

How Raising Taxes Will Not Balance the Budget: More Evidence

November 14, 2012 | Video

In an effort to help fix the deficit, many have advocated increasing taxes on America’s highest earners. The question becomes: is this a good way of increasing the amount of money that the government takes in? According to Professor Antony Davies, when the government raises taxes on top earners, the federal government actually collects less […]

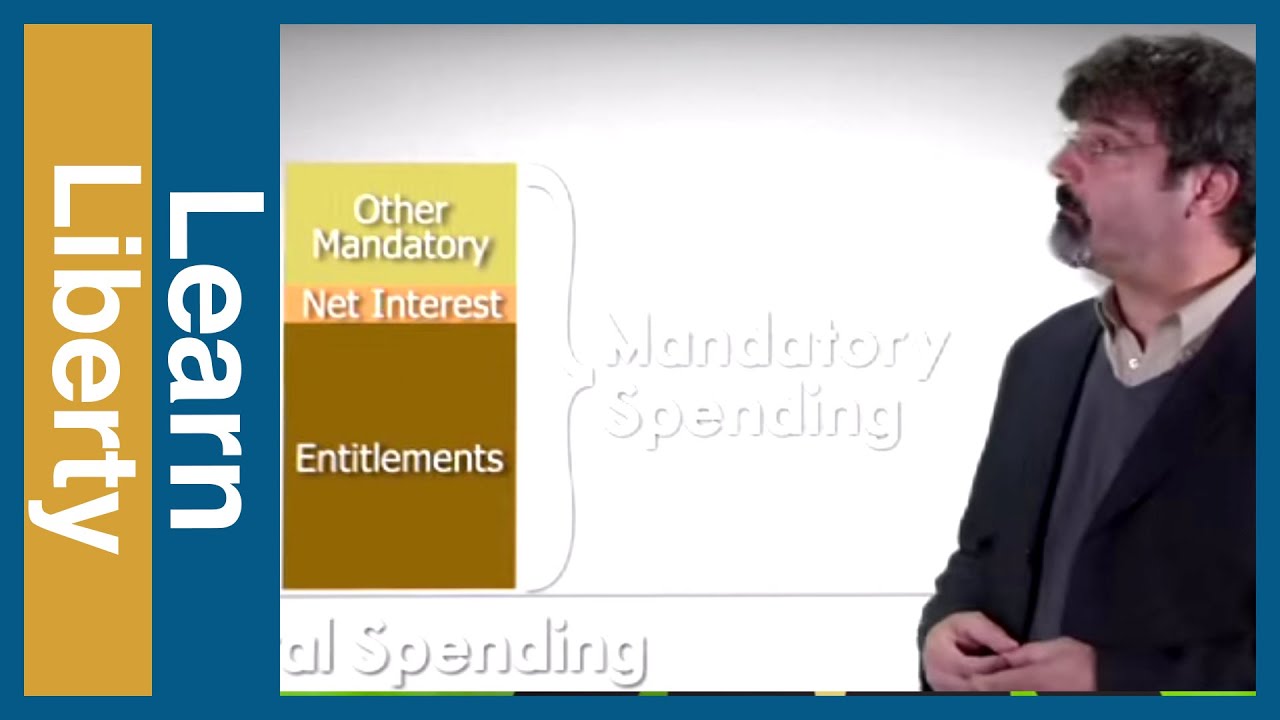

What Can We Cut to Balance the Budget?

October 12, 2012 | Video

In 2011, federal government spending significantly outweighed revenue. While the federal government spent $3.8 trillion, it collected only $2.2 trillion from various taxes, licenses, and fees. Professor Antony Davies breaks federal spending into five basic components. He further divides it into mandatory spending, which is an amount of spending automatically built into every budget by […]

Does Stimulus Spending Work?

October 3, 2012 | Video

After the housing bubble burst, both the Bush and Obama administrations turned to stimulus spending in an effort to improve U.S. economic growth. Stimulus spending is often justified by the thought that it is the government’s role to provide jobs in the economy. Yet the idea that the government can create jobs only looks at […]

Would Taxing the Rich Fix the Deficit?

July 2, 2012 | Video

In 2009, the government’s budget deficit was $1.5 trillion. Many have suggested raising taxes on the richest Americans to help offset the budget shortfall. Economics professor Antony Davies uses data to assess whether taxing the rich could possibly make up the difference. First, Professor Davies shows that the richest 5 percent of Americans already pay […]

Social Security vs. Private Retirement

May 2, 2012 | Video

A large part of your Social Security taxes goes towards a forced savings plan intended to provide Americans with money for retirement. Economics professor Antony Davies looks at the Social Security system, and discusses alternatives that may provide Americans with more retirement money and more financial security. To evaluate the merits of Social Security, Professor […]

Does Government Have a Revenue or Spending Problem?

April 25, 2012 | Video

People say the government has a debt problem. But what causes federal government debt? Deficits cause debt. Every time government spending is greater than the amount government collects in tax revenue, the government runs a deficit, which increases the debt. In this video, economics professor Antony Davies traces the root cause of government debt to […]

Will Higher Tax Rates Balance the Budget?

April 11, 2012 | Video

As the U.S. debt and deficit grows, some politicians and economists have called for higher tax rates in order to balance the budget. The question becomes: when the government raises taxes, does it actually collect a larger portion of the US economy? Professor Antony Davies examines 50 years of economic data and finds that regardless […]

Funding Government by the Minute

March 28, 2012 | Video

In 2011, the federal government received $2.2 trillion from all revenue sources and spent 3.8 trillion, resulting in a $1.6 trillion deficit. To put federal government spending in perspective, economics professor Antony Davies shows how long it takes the government to run out of money and how much the government needs to cut to make […]

What If the National Debt Were Your Debt?

March 26, 2012 | Video

The U.S. federal government collected $2.2 trillion in 2011. This includes revenue from all sources. Also in 2011, the federal government spent $3.8 trillion and was $14.6 trillion in debt. These numbers are too big to comprehend, so economics professor Antony Davies presents the government’s fiscal situation scaled down to the level of an average […]

What Are the Dangers of Too Much Debt?

March 20, 2012 | Video

The United States currently pays 3 percent interest on the government debt. Economics professor Antony Davies shows that this year the U.S. government owes $440 billion in interest alone. This is three times the annual operating expenses of the Iraq and Afghanistan wars. Using data, Professor Davies shows that the situation is likely to get […]

When Governments Cut Spending

September 28, 2011 | Video

Do governments ever cut spending? According to Dr. Stephen Davies, there are historical examples of government spending cuts in Canada, New Zealand, Sweden, and America. In these cases, despite popular belief, the government spending cuts did not cause economic stagnation. In fact, the spending cuts often accelerated economic growth by freeing up resources for the […]

How Should Governments Deal With Debt?

September 14, 2011 | Video

Nations that spend themselves into debt face very difficult choices. As Dr. Stephen Davies sees it, a country in debt has three potential options to fix their debt problem. The first option is some combination of raising taxes and cutting spending. The second is to repudiate on the debt. The third option is inflation. Among […]

How Government Crowds out Private Investment

August 19, 2011 | Video

Investment capital is scarce, which necessarily implies that there is a trade-off between government bonds and other types of economic activity. Put another way, investing $1.00 in government debt ensures that the same $1.00 will not be used for private investment or goods and services. According to historian Stephen Davies, government spending will almost always […]

Debts, Deficits, and Spending Cuts

May 24, 2011 | Video

Dr. Jeffrey Miron at Harvard explains America’s debt situation, which is projected to worsen in the coming years. In his estimation, an increase in taxes will only make the situation worse, as it will reduce productivity. Therefore, government spending must be cut. If not, America will be bankrupt and default on its debt.

Selling Social Security Personal Accounts

May 17, 2011 | Video

Peter Ferrara argues that Social Security benefits yield a lower rate of return than a typical blend of stocks and bonds. On top of this, it is highly unlikely that Social Security will be able pay all the benefits it has promised. Personal accounts, he argues, are the best alternative to the current Social Security […]

Social Security vs. Private Retirement Accounts

May 16, 2011 | Video

Prof. Antony Davies analyzes Social Security in the United States through the lens of a typical 22 year old American. Assuming that Social Security is completely solvent, the expected return on investment (ROI) of Social Security is far lower than the expected ROI of a private account. Further, if an individual could hypothetically opt out […]