Tag: inflation

What makes Bitcoin such a revolutionary concept?

January 3, 2024 | Post

In the 15 years since the Genesis Block, the first set of 50 BTCs, was mined in January 2009, Bitcoin’s profile and impact on the global economy has increased exponentially. Hundreds of millions of people around the world have begun to recognize the merits of the truly revolutionary concept of a decentralized peer-to-peer currency.

A history of money and the gold standard

July 28, 2023 | Post

The history of money is a story of human ingenuity and economic evolution. From the early days of bartering to the unfortunate establishment of fiat currency to a future rippling with potential thanks to cryptocurrencies, the concept of money has endured a wild ride.

5 Fiscal Policy Myths DEBUNKED

July 24, 2023 | Video

Tom Hogan has worked at the American Institute for Economic Research, the Cato Institute’s Center for Monetary and Financial Alternatives, and was Chief Economist for the U.S. Senate Committee on Banking, Housing, & Urban Affairs. Our Ethan Yang interviewed him and, in the process, Tom debunked 5 widely-held myths about fiscal and monetary policy. For […]

How financial surveillance and inflation are used to rob Americans

December 22, 2022 | Post

While inflation continues to severely impact the financial security of Americans, the IRS has warned business owners that they are legally obligated to report financial transactions of over $600 made through payment facilitators such as Venmo, CashApp, and PayPal.

Can the clever federal fox be outsmarted?

December 15, 2022 | Post

While the Federal Reserve prints more money to buy more things for the political establishment, the rest of us work to provide them with the resources they need for less pay in terms of purchasing power. So what can we do about it? Can we create alternatives to the Federal Reserve System?

How to prepare yourself for hyperinflation: tips from the Venezuelan experience

December 8, 2022 | Post

While true hyperinflation does not happen often, it’s always good to know the measures you could take to overcome the challenges presented by hyperinflation if ever it occurs in your country (and the chances are never quite zero.)

Libertarian solutions to inflation

November 10, 2022 | Post

As long as half of the country believes that inflation is caused by the war in Ukraine, COVID, corporate profits, or that inflation like this is new and temporary, there will never be proper solutions. At best, it will be viewed as one of those random problems we must deal with when we have a crisis. At worst, policies like price controls and other government interventions will gain steam. Instead, we must move to cure inflation with more liberty.

Stop stealing our future: why inflation matters for everyone

November 10, 2022 | Post

Today, after record prices hit the everyday goods Americans use – food, housing, gas; everyone is familiar with the I-word. However, Americans are struggling to understand how inflation happens and why it matters so much.

Why was this year’s 4th of July cookout so expensive?

July 5, 2022 | Post

According to a survey from the American Farm Bureau Federation, the cost of an average 4th of July feast is up by 17 percent from 2021. Why is this?

Prof. Antony Davies: 10 Myths About Inflation

April 13, 2022 | Video

Inflation is the word of the day; rates in the United States have hit 40-year highs, and seemingly everyone is feeling the pain — from the gas pump to the grocery store. But with growing media attention also comes bad or misleading information. To set the record straight, we brought in the heavy muscle: Learn […]

Five myths about inflation

April 12, 2022 | Post

In order to be able to address the root problems of inflation, we need to dispel some common myths. Here are our top five picks:

Is Modern Monetary Theory A Valid Policy?

December 1, 2021 | Video

The United States government is, yet again, facing a budget crisis. Government funding is set to expire on December 3, 2021 and Congress has a deadline of December 15 to raise the debt ceiling. Otherwise, the U.S. will default on its debts, and a worldwide financial collapse becomes a possibility.

Modern Monetary Theory (MMT) is part of the reason these crises — not to mention inflation — are becoming more common. It theorizes that because modern states control currency and have the power to levy taxes, they can print as much money as they want.

Prof. Antony Davies: Why the US doesn’t want inflation, explained

July 30, 2021 | Video

Vox recently posted a video explaining how inflation works and why some people want inflation to rise in the US. However, they are not telling the whole story, so we had to set the record straight.

We invited our good friend, professor Antony Davies, to explain what inflation is and how that affects the lives of everyone. He talks about how inflation erodes people’s purchasing power, the role of politicians in all this, and what people can do to protect themselves against inflation. We want to hear what your savings strategies are against inflation. Comment them down below!

Alexander Hamilton, a Second-Hand Dealer in Retrograde Mercantilist Ideas

September 11, 2016 | Post

[Alexander Hamilton] was decidedly retrograde in pushing for an exclusive nationwide bank with a sweetheart government deal. He was not a creative policy genius so much as a persuasive second-hand dealer in discredited mercantilist ideas.

How Far Does $100 Get You In Your State?

August 24, 2016 | Post

The relative worth of a dollar is dependent on a range of factors that vary from state to state.

The Consequences of Ignoring Economics in Public Policy

July 12, 2016 | Post

Why does economic education matter? Look no further than the ongoing crisis in Venezuela, where the Washington Post is reporting that food shortages are so bad that people are attacking food trucks when they make deliveries. It all started when Hugo Chavez and his successor, Nicolas Maduro, tried to formulate public policy while ignoring economics. […]

Venezuela, Socialism, and The Unlearned Lessons of Political Economy

June 15, 2016 | Post

The news from Venezuela just keeps getting worse: runaway inflation, rolling electricity blackouts, shortages of even the most basic goods, people dying in hospitals waiting for care that just doesn’t ever arrive. The world looks on, appalled at the spreading miseries, and asks: “Why is this happening?” And, “What can be done about it?” These […]

Have Wages Stagnated?

January 5, 2016 | Post

In this video professor Don Boudreaux responds directly to commentator Robert Reich on the topic of wages, particularly the claim that middle class wages have stagnated in recent decades.

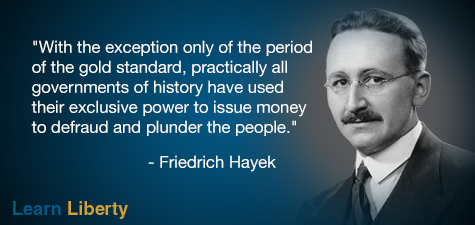

Quote of the Day: Hayek on Money

December 22, 2015 | Post

F.A. Hayek was highly critical of central banking and of government’s proclaimed interest in holding a monopoly on the issuance of money. Hayek eventually turned his opinions on money and free banking into an economic treatise in the book “The Denationalization of Money“. Some even say Hayek predicted the emergence of Bitcoin nearly three decades […]