Here’s a brainbuster for you:

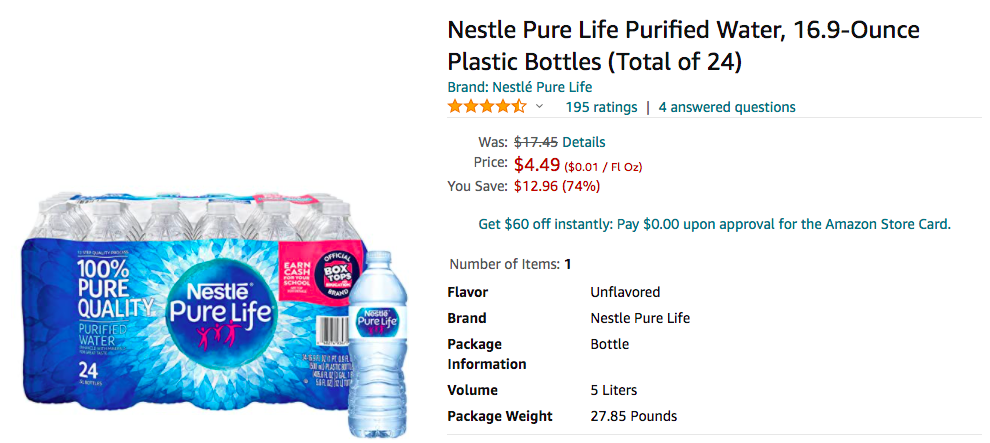

The product on the left will help keep you alive for 6-8 weeks. It costs $4.49. The other is nothing more than pretty to look at. It costs $161.

Why?

This paradox — the water-diamond paradox — troubled some of the world’s greatest minds. Plato wondered about it; Copernicus and Adam Smith did, too.

But Carl Menger was the first to provide a satisfactory explanation. He did it 150 years ago, in 1871, and his answer still holds up.

“The force that drives [prices],” he wrote in his Principles of Economics, “is the ultimate and general cause of all economic activity: the endeavor of men to satisfy their needs as completely as possible, to better their economic positions.”

Whereas Smith — and, later, Karl Marx — posited the “labor theory of value,” which attributed the price of goods to the amount of labor or cost that went into creating them, Menger went another direction. His “subjective value theory” acknowledged that each human is an individual actor and that we each exist in different contexts and have different desires. One person might, therefore, be willing to pay more for a movie ticket than for a ticket to a ballgame.

How does this theory of value solve the water-diamond paradox?

Consider a man who buys four bottles of water per day. He will, naturally, use the first bottle to take care of the most urgent need the water can satisfy: quenching his thirst. The next bottle, he might give to his wife so that she can drink; the third might be poured into his dog’s water bowl; and the fourth might be poured at the base of his favorite tree.

And if, one day, the man is only able to buy three bottles of water? His lowest priority — the tree — will go without.

In other words, people who are looking to buy a diamond probably don’t need an extra bottle of water to survive.

Because are all individuals, we can only interact with individual goods — not with the entire supply of water in the world, or the global supply of diamonds. Therefore, the value of a good is determined by what you can do with one more unit of the good, not by the nature of the good itself.

This discovery of Menger’s gave rise to the marginal revolution in economics. It also led to one of his most powerful insights: that both sides gain from voluntary exchange.

Menger’s explanation for how money develops also remains influential — and perhaps more important than ever in today’s era of inflation spurred by governments’ haphazard money printing. He pointed out that if people were to barter, they could rarely get what they want in just one transaction. If you want a backpack, for example, and are offering a watch for it, you would have to look long and hard to find someone with a backpack to trade who wants the watch you have.

Money, therefore, develops not by governmental decree or fiat, but naturally — in much the same way language does — to facilitate communication and trade among people.

Menger was born on February 28, 1840 in what is now southern Poland but which was, at the time, part of the Austrian Empire. He probably never would have guessed, when he left home to study law in Vienna as a young man, that he would become the Father of Austrian Economics.