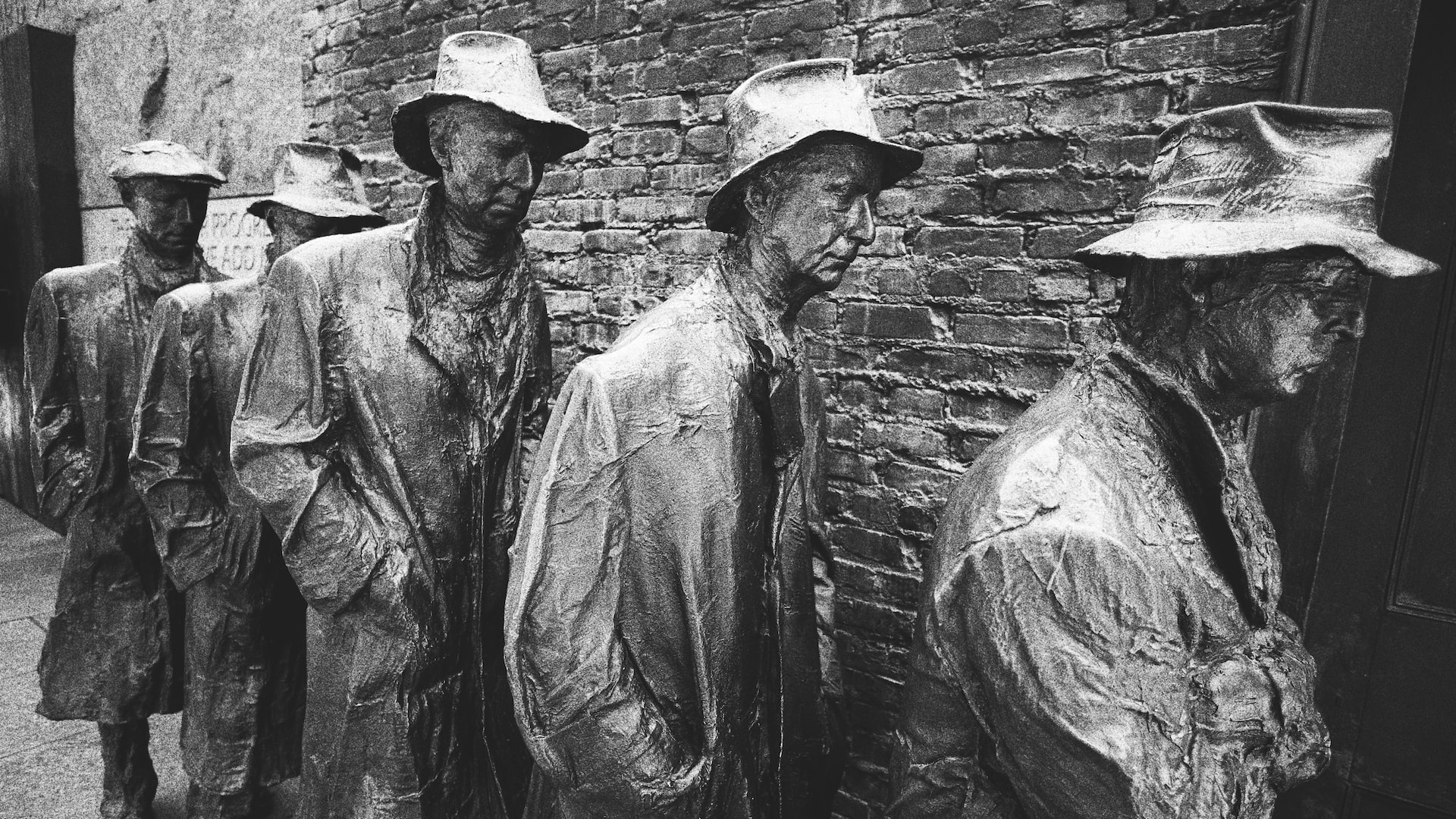

The Great Depression is one of the most misunderstood periods in American history.

It has become symbolic for American progressives. FDR’s New Deal is seen, and taught, as the great piece of legislation that saved America, and has become synonymous with big government programs that aim to do the same.

But the idea that unchecked capitalism ruined the economy and big government saved us is simply a myth that is only “true” because it is repeated ad nauseam. Once you do a little digging, there’s more than meets the eye to this desperate period of American history.

Here are some of our top myths about the Great Depression:

Myth #1: The stock market crash of October 1929 marked the beginning of the Great Depression

The idea that the Great Depression began with the stock market crash of October 1929 is a widely held belief that is often repeated in history books. However, the recession that ultimately became the Great Depression actually began in August 1929 as US economic output began to decline – two months prior to the stock market crash. Thus, the crash is more an effect rather than a cause of the Great Depression.

In the years leading up to these events, the Federal Reserve made huge increases to the money supply. Indeed, the money supply increased by around 40 percent between the early 1920s and 1929. In such a scenario, significant inflation would normally be expected, yet this did not occur.

The reason for this was that a large part of the inflation was hidden in a stock market bubble that the Federal Reserve helped create with the massive increase in the money supply. In October 1929, this stock market bubble burst.

Real losses from this bursting bubble occurred when the Federal Reserve conducted a significant contraction in the money supply right as the economy desperately needed liquidity. Consequently, it became more difficult for people to pay each other, compounding an economy already in decline.

Myth #2: President Herbert Hoover’s “laissez-faire” economic policies caused the depression

Often, a significant level of blame for the Great Depression has been leveled at the “laissez-faire” policies of President Herbert Hoover, and this theory is partially true. While the Hoover administration’s policies undoubtedly led the recession to extend into a depression, the idea that these were laissez-faire is a bit of a joke.

Hoover’s policies were outright interventionist. In 1930, he signed into law the Smoot-Hawley Tariff Act, increasing import tariffs on some 20,000 goods up to 50 percent, with the intended purpose of “protecting American industry.”

Previously, when the House passed the bill in May 1929, the stock market fell by 8 percent. The stock market crash five months later came just days after the Senate had added further tariffs to the bill.

When the Federal Reserve panicked and began a contraction of the money supply, prices were falling. Hoover’s response, in a bid to protect the incomes of American workers, was to strongarm businesses into maintaining wages at existing levels.

Under pressure not to cut wages in response to falling prices, businesses were left with no choice but to lay off workers, thus fueling a crisis that culminated in 25 percent unemployment nationwide.

Regardless of what he may have said in support of free markets, Hoover’s political actions told a different story.

Myth #3: Bank mismanagement and profiteering was responsible for insolvency and bank runs

In the US, some 8 to 10 thousand banks, or around one in three, failed over the course of the Great Depression. In Canada, however, where the effects of the Great Depression were felt almost as acutely as in the US, there were zero bank failures. But how come?

The answer is different government policies. In the US, the government prohibited banks from operating branches across the country, under the pretext of preventing banks from becoming large and powerful.

What this meant is that these smaller, local banks were unable to diversify and could only conduct business in a limited geographic area, thus making their business model extremely susceptible to worsening economic conditions in that area.

In contrast, banks that could operate nationwide were in a much better position to diversify and insulate themselves against economic downturns to a greater extent. In Canada, banks could do exactly that, as the Canadian government allowed its banks to operate nationwide.

Myth #4: The New Deal brought an end to the Great Depression

The New Deal policies of President Franklin Delano Roosevelt are often credited with bringing an end to the Great Depression. However, in reality, this was far from being the case.

FDR’s package of economic policies known as the New Deal vastly expanded the scope of government in response to the Great Depression. As part of this package, the Roosevelt administration interfered with agricultural and industrial prices, established a number of new government agencies, and set up various public works and social programs.

While they greatly diminished competitiveness and increased dependency on the state, FDR’s New Deal package did little to alleviate the crisis. Indeed, during Roosevelt’s first two terms in office, unemployment rates lingered stubbornly around 18 percent on average and both the national income and industrial output fell by almost a third over the course of the 1930s.

It would be many more years before pre-Depression conditions returned. Furthermore, Roosevelt’s policies, such as the National Industrial Recovery Act of 1933, created an agency responsible for drawing up industrial codes to be imposed on companies in a bid to plan and regulate the economy. It ultimately favored larger companies over smaller ones. While the NIRA was subsequently struck down as unconstitutional in 1935, many of its provisions were later reenacted in future legislation.

Indeed, it was not until the escalation of government intervention that the US was faced with a depression that ultimately took the best part of a generation to fully recover from. Coincidence? I think not.

President Franklin Delano Roosevelt’s policies undoubtedly prolonged the misery of the Great Depression and left a legacy that has had a continued detrimental effect ever since.

Myth #5: World War II brought an end to the Great Depression

Finally, one of the most egregious myths about the Great Depression is that World War II can be credited with bringing it to an end.

As the woes of the Great Depression persisted, exacerbated by President Roosevelt’s interventionist economic policies, World War II was merely able to hide the lingering crisis. The war was able to artificially make the issue of unemployment seemingly disappear as the unemployed would be drafted into the military or involved in the production of military equipment.

However, the temporary reduction in unemployment and diversion of capital towards the war effort did not result in any meaningful increase in prosperity. Besides, when the war ended and those drafted returned home, unemployment shot up again.

As the celebrated Austrian economist Ludwig von Mises puts it in his book, Nation, State, and Economy:

“War prosperity is like the prosperity that an earthquake or a plague brings. The earthquake means good business for construction workers, and cholera improves the business of physicians, pharmacists, and undertakers; but no one has for that reason yet sought to celebrate earthquakes and cholera as stimulators of the productive forces in the general interest.”

For more context on myths about the Great Depression, be sure to check out our video below with Prof. Antony Davies.

This piece solely expresses the opinion of the author and not necessarily the organization as a whole. Students For Liberty is committed to facilitating a broad dialogue for liberty, representing a variety of opinions.