President Trump has repeatedly claimed that the United States is the highest-taxed country in the world. Now, Trump may well be poorly informed on this issue, but the data people are using to fact-check him are misleading. Compared to other countries, US taxes are much higher than simple numbers show.

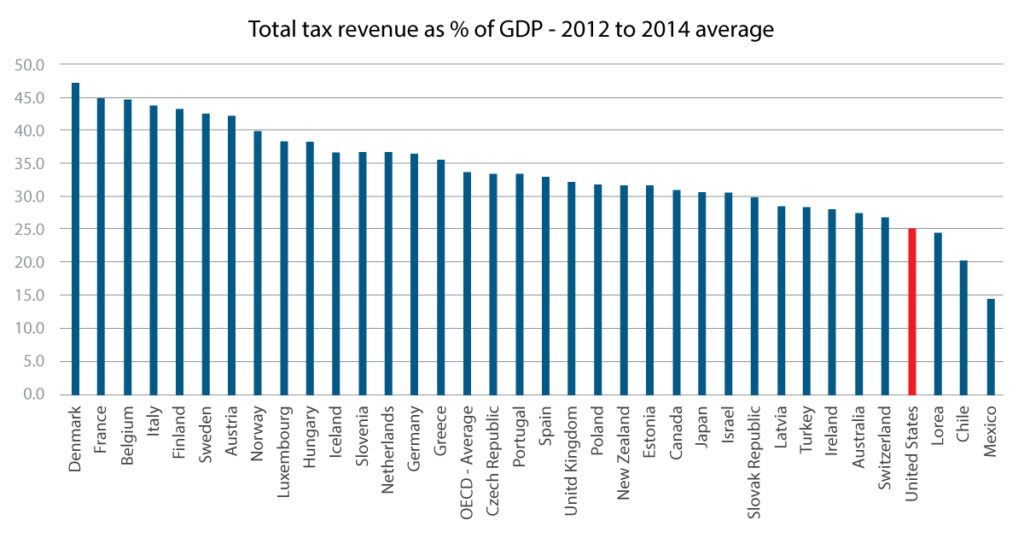

You might have seen a chart like the one above, comparing the United States to other high-income countries on total tax revenue as a percentage of gross domestic product (GDP).

So what’s misleading about these data? The United States looks like a low-tax nation in part because it gives far more tax deductions and credits than other countries, particularly for social programs. According to the Government Accountability Office, so-called “tax expenditures” cost the federal government more than $1.2 trillion in 2015, roughly equal to federal discretionary spending and more than a quarter of all federal, state, and local tax revenues.

The Effect of Tax Deductions, Tax Exemptions, and Tax Exclusions

To see why tax expenditures matter, think about two possible ways governments could encourage individuals to buy health insurance. Let’s use the example of two totally imaginary countries: Nordicland and Merica.

In both countries, the governments tax everyone’s income at 25%, and fund most government programs that way. But health care in both countries is handled differently.

In Nordicland, the government levies an additional $1,000 per person annual tax to pay for citizens’ health insurance. From that additional health insurance tax, the Nordicland government skims $100 off the top for administration and returns $900 to each person to pay toward the cost of health insurance.

In the second country, Merica, the government just excludes employer-provided health insurance from the 25% income taxation. Let’s say that, on average, the Mericans receive $3,600 worth of health insurance through their employers. This means they get a benefit of $900 (25% of $3,600) in taxes not paid. And let’s say the government again takes $100 (out of that $3,600) for administration.

Whose taxes are really higher: Nordiclanders’ or Mericans’? According to measured tax revenues, Nordiclanders pay $1,000 more person in taxes than Mericans. But in reality, both Nordiclanders and Mericans pay the same cost for their government interference in health insurance purchase decisions. They both pay a $100 administrative expense, and they both pay some opportunity cost from not being able to spend $900 however they want to spend it, but instead having to spend it on health insurance. Their “real” tax rate is about the same.

The Freedom to Spend and Save Your Income

What we really want to know is how much of what you earn you can spend however you like. In the real world, we don’t know the answer to that question. The tax and spending regimes of every country are just too complicated to figure out that percentage.

It seems unlikely the United States has the highest “real” tax rate in the world, but the real tax rate Americans face is significantly higher than the measured tax rate. That’s because Americans have to spend a lot more than people in other countries in figuring out how much to pay and, more importantly, on the opportunity costs of having to spend on certain things and not others to benefit from the United States’ myriad tax deductions, credits, and exclusions.